Family Economic Security: Building a Stable Financial Future

Building a Stable Financial Future

In today’s dynamic economic landscape, ensuring family economic security is paramount for a stable and prosperous future. Achieving financial stability involves strategic planning and a commitment to making informed decisions. This article explores key aspects of family economic security and provides insights into creating a robust financial foundation.

Understanding the Importance of Economic Security

Economic security goes beyond having a steady income; it involves safeguarding against unforeseen challenges and ensuring that the family’s financial well-being is resilient. This includes having savings, investments, and insurance to mitigate risks and uncertainties.

Budgeting for Financial Stability

One of

Smart Financial Choices: Navigating Wealth Wisely

Navigating Wealth Wisely: Smart Financial Choices

Introduction: The Foundation of Financial Success

Smart financial choices serve as the bedrock of financial success. This article delves into the principles and strategies that individuals can adopt to make informed decisions, secure their financial future, and achieve their monetary goals.

Building a Solid Budget: The Cornerstone of Financial Planning

At the heart of smart financial choices lies the construction of a robust budget. Crafting a budget involves meticulous planning, tracking income and expenses, and prioritizing financial goals. This foundational step provides a clear overview of one’s financial landscape, laying the groundwork for informed

Smart Strategies for Household Budgeting

Smart Strategies for Household Budgeting

Understanding the Importance of Budgeting

Effective household budgeting is the cornerstone of financial stability and responsible money management. It involves strategically allocating income to cover expenses, save for the future, and potentially invest. This article explores smart strategies for household budgeting, providing insights into achieving financial well-being.

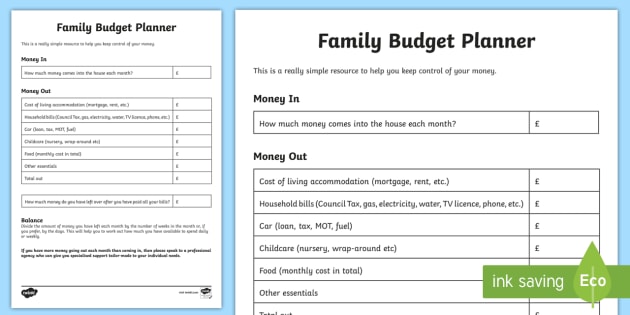

Creating a Realistic Budget

The first step in effective household budgeting is to create a realistic budget that reflects your income, expenses, and financial goals. Take a comprehensive look at your monthly income, including all sources of earnings. Subsequently, list and categorize your regular expenses such as rent

Family Budgeting Tools: Financial Planning for Success

Financial Harmony: Navigating Family Budgeting Tools

Creating and managing a family budget is a crucial aspect of financial well-being. In today’s digital age, a myriad of family budgeting tools is available, each offering unique features to streamline financial planning. This article explores the significance of family budgeting tools and how they contribute to financial success.

The Importance of Family Budgeting

A family budget serves as a roadmap for financial stability. It helps households allocate resources efficiently, manage expenses, and save for future goals. A well-crafted budget is a fundamental tool for achieving financial security and ensuring that a family’s needs

Strategic Finances: Navigating with Wise Financial Planning

Strategic Finances: Navigating with Wise Financial Planning

Effective financial planning is a cornerstone of achieving long-term financial goals and securing a stable future. Wise financial planning involves a comprehensive approach that encompasses budgeting, investing, and risk management. This article explores the key principles and strategies behind wise financial planning and its impact on personal and business financial well-being.

The Foundation: Building a Solid Financial Plan

At the heart of wise financial planning lies the development of a solid financial plan. This involves assessing current financial status, setting realistic goals, and creating a roadmap to achieve them. A well-structured financial plan

Empowering Finances: Personal Finance Education

Empowering Finances: Personal Finance Education

Financial literacy is a cornerstone of individual empowerment and well-being. In this article, we delve into the significance of personal finance education, exploring its impact on financial decision-making, long-term planning, and overall financial health.

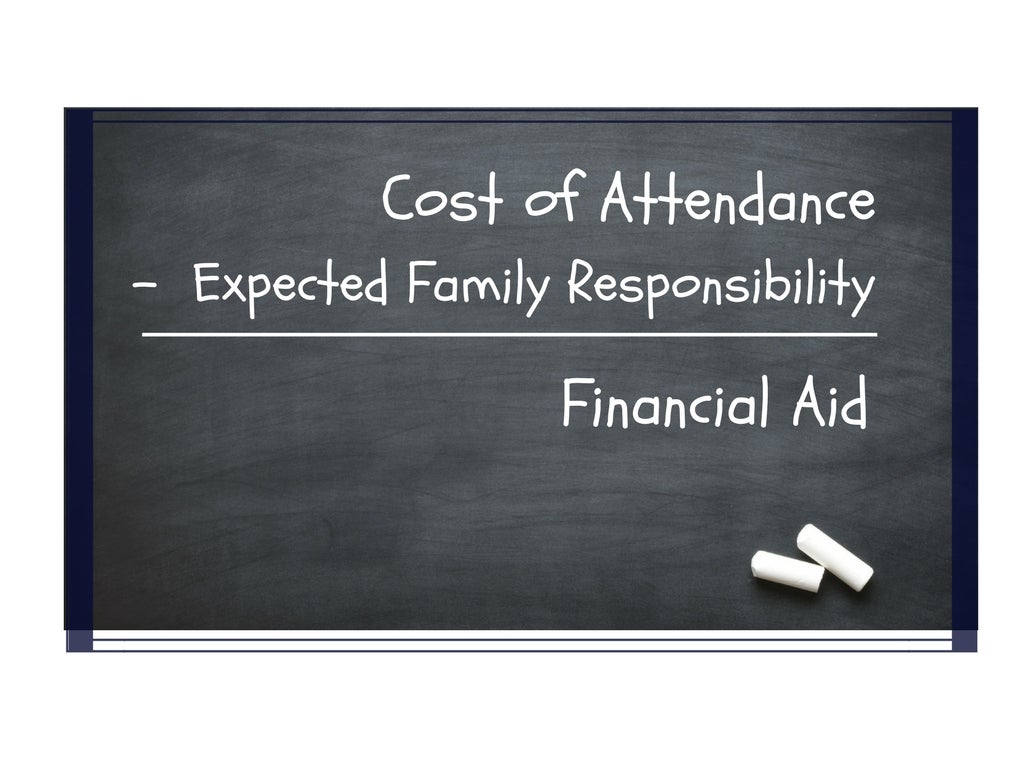

Understanding the Basics of Personal Finance

Personal finance education starts with understanding the basics. It encompasses budgeting, saving, investing, and debt management. Individuals gain insights into creating a balanced financial plan that aligns with their goals and lifestyle. This foundational knowledge forms the bedrock for informed financial decisions.

Navigating the Complexities of Budgeting

Budgeting is a fundamental aspect of personal finance

Financially Responsible Families: Nurturing Prosperity Together

Financially Responsible Families: Nurturing Prosperity Together

Financial responsibility within families is a cornerstone for long-term stability and prosperity. This article explores the importance of financial responsibility, outlines key practices for families, and offers insights into nurturing a financially secure future.

The Foundation of Financial Responsibility

Financial responsibility is more than just managing money; it involves making informed and mindful decisions about spending, saving, and investing. Families that understand the importance of this foundation set the stage for a secure and prosperous future.

Budgeting as a Family Unit

One of the fundamental practices for financially responsible families is creating and adhering

Financial Setback Concerns: Navigating Challenges and Recovery

Financial Setback Concerns: Navigating Challenges and Recovery

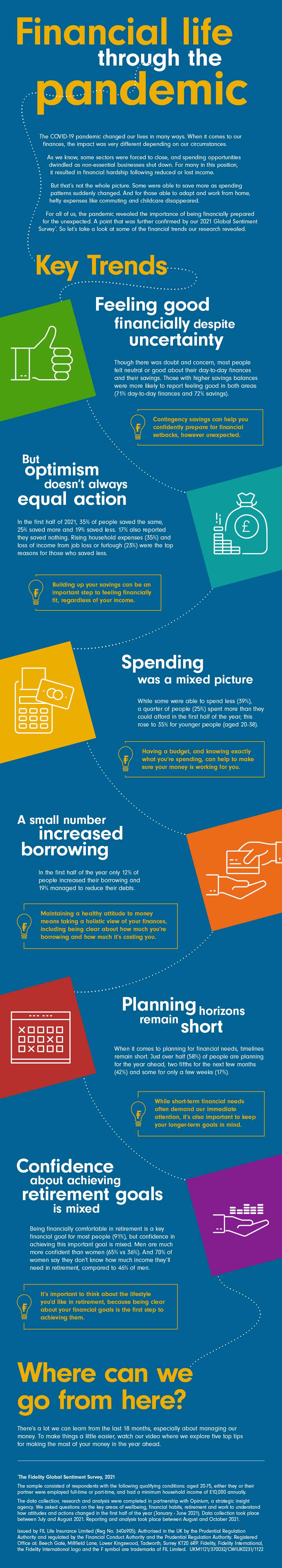

Financial setbacks can be unexpected and challenging, impacting individuals and businesses alike. This article delves into the concerns surrounding financial setbacks, addressing the various challenges they pose and exploring strategies for recovery.

Understanding the Impact of Financial Setbacks

Financial setbacks can manifest in various forms, from unexpected expenses and market downturns to job loss and economic downturns. Understanding the specific impact on personal finances or business operations is crucial for devising an effective recovery plan.

Challenges Faced by Individuals

For individuals, financial setbacks can lead to stress, anxiety, and uncertainty. Job loss or

Building Family Wealth: Strategies for Financial Success

Building Family Wealth: Strategies for Financial Success

Financial success is a common aspiration for families, and achieving it requires thoughtful planning and strategic decision-making. In this article, we explore key strategies that families can adopt to build and sustain financial success, fostering long-term stability and prosperity.

Setting Financial Goals: The Foundation of Success

The journey towards family financial success begins with setting clear and achievable financial goals. These goals act as a roadmap, providing direction and purpose for financial decisions. Whether it’s saving for education, homeownership, or retirement, having well-defined goals helps guide family financial planning.

Budgeting Basics: Managing Income