Financially Responsible Families: Nurturing Prosperity Together

Financial responsibility within families is a cornerstone for long-term stability and prosperity. This article explores the importance of financial responsibility, outlines key practices for families, and offers insights into nurturing a financially secure future.

The Foundation of Financial Responsibility

Financial responsibility is more than just managing money; it involves making informed and mindful decisions about spending, saving, and investing. Families that understand the importance of this foundation set the stage for a secure and prosperous future.

Budgeting as a Family Unit

One of the fundamental practices for financially responsible families is creating and adhering to a budget. Establishing a budget involves tracking income, categorizing expenses, and setting realistic financial goals. It’s a collaborative effort that instills financial discipline and transparency within the family.

Teaching Financial Literacy to Children

Financial responsibility begins at an early age. Families committed to nurturing prosperity educate their children about money matters. Teaching concepts like budgeting, saving, and the basics of investing equips children with essential life skills for managing finances responsibly.

Open Communication about Finances

Communication is key to financial responsibility within families. Open and honest discussions about financial goals, challenges, and decisions foster a collaborative approach. This transparency ensures that all family members are aligned in their financial aspirations and understand the importance of working together.

Emergency Funds and Contingency Planning

Financially responsible families recognize the importance of preparing for unexpected events. Establishing emergency funds and contingency plans provides a financial safety net during unforeseen circumstances, reducing stress and ensuring the family’s ability to weather financial storms.

Saving for Education and Future Goals

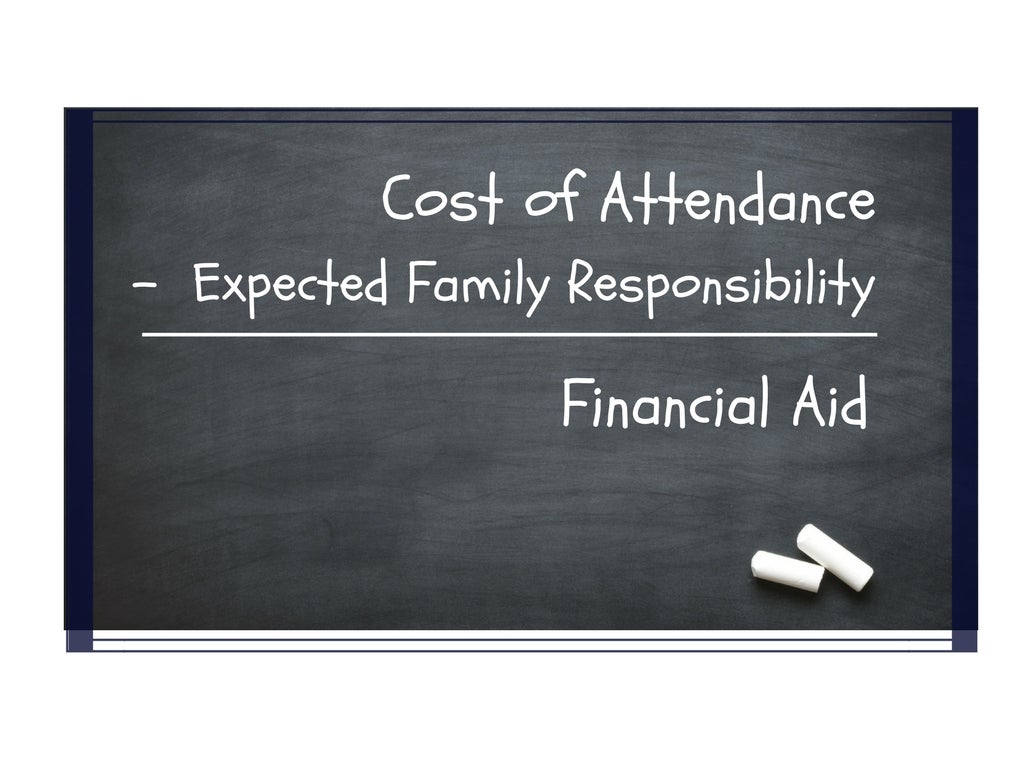

Investing in the future is a core aspect of financial responsibility. Families prioritize saving for education, homeownership, and other long-term goals. This forward-thinking approach ensures that the family is financially prepared for significant milestones and can navigate life transitions with confidence.

Debt Management and Avoidance

Being financially responsible involves strategic debt management and, whenever possible, avoiding unnecessary debt. Families work together to understand the implications of debt, create plans for repayment, and make informed decisions to maintain a healthy financial standing.

Smart Spending Habits and Consumer Awareness

Financially responsible families cultivate smart spending habits and consumer awareness. This includes making informed choices about purchases, seeking value for money, and avoiding impulsive spending. These habits contribute to long-term financial well-being.

Investing for Long-Term Growth

Investing is a key component of building wealth and ensuring long-term financial security. Families explore investment options that align with their goals, risk tolerance, and time horizon. This strategic approach to investing contributes to the family’s financial growth over time.

Regular Financial Check-Ins

Financial responsibility is an ongoing commitment. Families conduct regular financial check-ins to assess progress, adjust goals, and address any emerging challenges. These check-ins provide an opportunity for course correction and reinforce the family’s commitment to financial well-being.

Financially Responsible Families URL Link

Nurturing financially responsible families is a journey that requires dedication and collaboration. To explore more insights on achieving financial responsibility within your family, visit corpodaration.my.id.

In conclusion, financial responsibility within families is not just about managing money; it’s a holistic approach to creating a secure and prosperous future. By embracing practices such as budgeting, teaching financial literacy, and making informed financial decisions, families can build a foundation for long-term financial well-being.