Financial Harmony: Navigating Family Budgeting Tools

Creating and managing a family budget is a crucial aspect of financial well-being. In today’s digital age, a myriad of family budgeting tools is available, each offering unique features to streamline financial planning. This article explores the significance of family budgeting tools and how they contribute to financial success.

The Importance of Family Budgeting

A family budget serves as a roadmap for financial stability. It helps households allocate resources efficiently, manage expenses, and save for future goals. A well-crafted budget is a fundamental tool for achieving financial security and ensuring that a family’s needs are met without unnecessary financial strain.

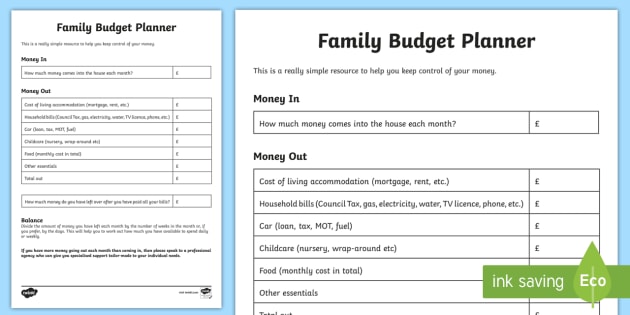

Understanding Family Budgeting Tools

Family budgeting tools come in various forms, from traditional spreadsheets to modern apps and software. These tools are designed to simplify the budgeting process, providing insights into income, expenses, and savings goals. Understanding the features of these tools is crucial for selecting the one that aligns with a family’s specific needs.

Categorizing and Tracking Expenses

One of the primary functions of family budgeting tools is the categorization and tracking of expenses. These tools allow users to classify expenditures into categories such as housing, utilities, groceries, and entertainment. By tracking spending patterns, families gain insights into where their money is going and can identify areas for potential savings.

Setting Realistic Financial Goals

Family budgeting is not just about managing day-to-day expenses; it’s also about setting and achieving financial goals. Budgeting tools enable families to define realistic goals, whether it’s saving for a vacation, creating an emergency fund, or planning for major expenses like education or homeownership.

Automation for Efficiency

Many modern budgeting tools offer automation features, streamlining the budgeting process. Automated transactions, bill payments, and savings contributions ensure that families stay on track without the need for manual interventions. This automation not only saves time but also reduces the risk of oversights in financial management.

Debt Management and Financial Health

For families dealing with debt, budgeting tools play a crucial role in debt management. These tools can provide insights into debt repayment strategies, interest rates, and timelines for becoming debt-free. Monitoring debt within the budgeting framework contributes to overall financial health.

Collaborative Budgeting for Families

In households with multiple earners, collaborative budgeting becomes essential. Some family budgeting tools offer collaborative features, allowing all members to contribute to the budgeting process. This inclusivity fosters financial transparency and ensures that everyone has a say in shaping the family’s financial future.

Financial Tracking on the Go

The convenience of accessing financial information on the go is a hallmark of many modern budgeting tools. Mobile apps allow families to monitor their budgets in real-time, check account balances, and receive alerts for upcoming bills. This accessibility empowers families to make informed financial decisions anytime, anywhere.

Security and Privacy Considerations

As families embrace digital tools for budgeting, security and privacy considerations are paramount. Choosing reputable and secure budgeting tools is essential to safeguard sensitive financial information. Families should prioritize tools with robust encryption and authentication features to protect their financial data.

Educational Resources and Support

Beyond the basic functionalities, some family budgeting tools offer educational resources and support. These may include financial literacy content, tips for effective budgeting, and access to experts or community forums. Tools that prioritize financial education contribute to the long-term financial empowerment of families.

To learn more about Family Budgeting Tools, visit corpodaration.my.id. Embracing these tools is not just about managing money; it’s a journey towards financial empowerment and the achievement of family aspirations.