Smart Financial Choices: Navigating Wealth Wisely

Navigating Wealth Wisely: Smart Financial Choices

Introduction: The Foundation of Financial Success

Smart financial choices serve as the bedrock of financial success. This article delves into the principles and strategies that individuals can adopt to make informed decisions, secure their financial future, and achieve their monetary goals.

Building a Solid Budget: The Cornerstone of Financial Planning

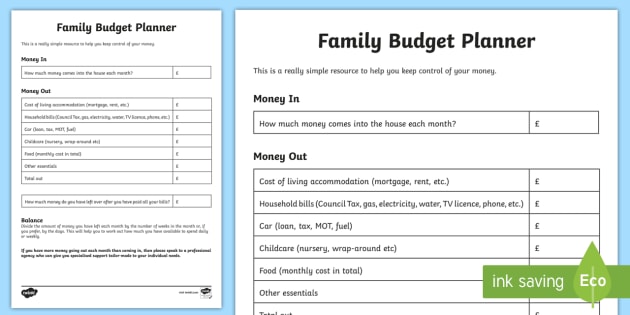

At the heart of smart financial choices lies the construction of a robust budget. Crafting a budget involves meticulous planning, tracking income and expenses, and prioritizing financial goals. This foundational step provides a clear overview of one’s financial landscape, laying the groundwork for informed

Family Budgeting Tools: Financial Planning for Success

Financial Harmony: Navigating Family Budgeting Tools

Creating and managing a family budget is a crucial aspect of financial well-being. In today’s digital age, a myriad of family budgeting tools is available, each offering unique features to streamline financial planning. This article explores the significance of family budgeting tools and how they contribute to financial success.

The Importance of Family Budgeting

A family budget serves as a roadmap for financial stability. It helps households allocate resources efficiently, manage expenses, and save for future goals. A well-crafted budget is a fundamental tool for achieving financial security and ensuring that a family’s needs

Building Wealth Together: Family Investment Planning

Building Wealth Together: Family Investment Planning

Family investment planning is a strategic approach to managing finances that involves the entire family. This article explores the significance of family investment planning, its key components, and the long-term benefits it offers to families seeking financial security and prosperity.

The Foundations of Family Investment Planning

At the core of family investment planning is the recognition that financial decisions impact the entire family unit. This approach involves open communication, joint decision-making, and a shared commitment to long-term financial goals. By establishing a solid foundation based on trust and collaboration, families can navigate the complexities

Thrifty Family Living: Smart Strategies for Budget Success

Smart Strategies for Budget Success in Thrifty Family Living

In a world where financial responsibilities often weigh heavily on families, adopting a thrifty lifestyle can be a game-changer. Thrifty family living involves making intentional choices to stretch your budget and achieve financial goals without sacrificing quality of life. Let’s explore some smart strategies for thriving in thrifty family living.

Budgeting Basics: Setting the Foundation

At the core of thrifty family living is a well-crafted budget. Begin by analyzing your income, fixed expenses, and discretionary spending. Allocate funds for necessities, savings, and debt repayment. A clear budget provides a roadmap for

Empowering Generations: Family Wealth Education

Empowering Generations: Nurturing Wealth Education within Families

Introduction: The Significance of Family Wealth Education

In the journey of wealth management, family wealth education plays a pivotal role in ensuring a legacy of financial understanding and responsible stewardship. This article explores the importance of family wealth education, its impact on generational wealth, and strategies to empower family members with financial knowledge.

Foundations of Financial Literacy: Starting Early

The roots of financial literacy are often embedded in childhood. Family wealth education begins by instilling basic financial concepts at an early age. Teaching children about budgeting, saving, and the value of money lays