Inflation’s Reach: Navigating Economic Impact

Economic inflation, the persistent increase in the general price level of goods and services, casts a broad and profound impact on various facets of an economy. In this exploration, we dissect the implications of inflation, from the individual level to the macroeconomic landscape, shedding light on strategies for navigating its complexities.

Understanding the Dynamics of Economic Inflation

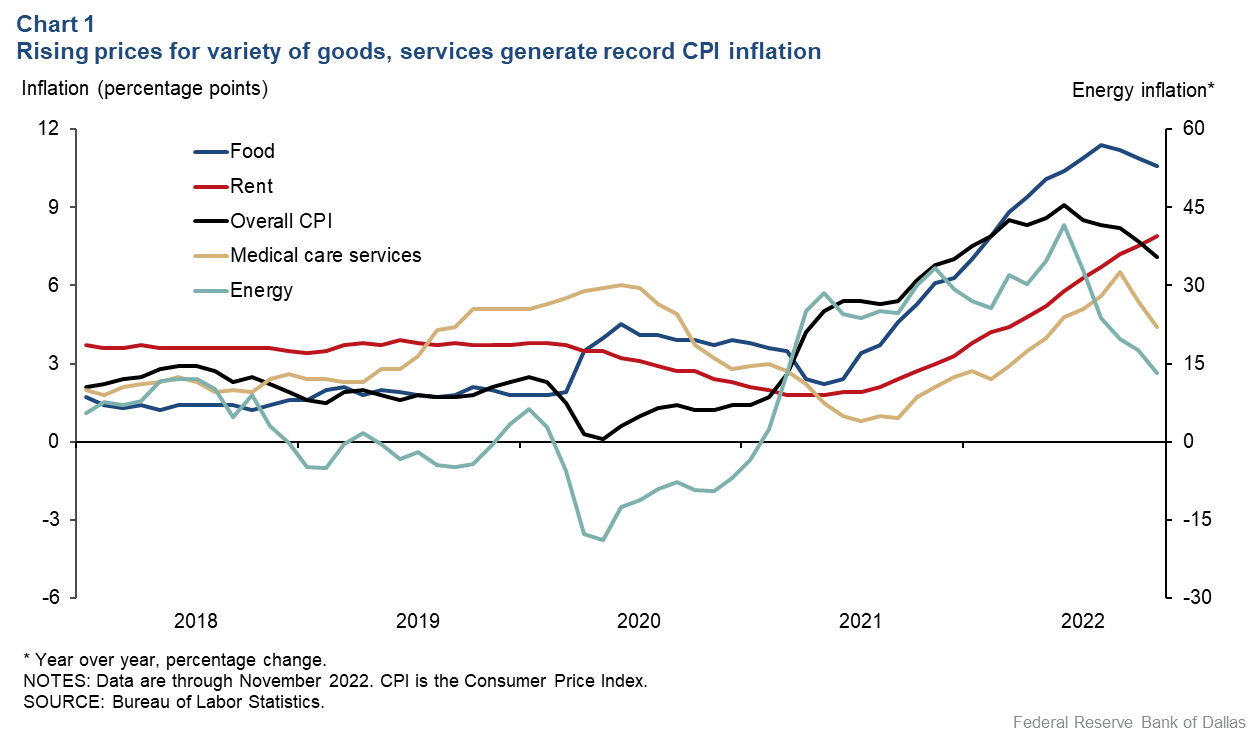

At its core, economic inflation results from an imbalance in supply and demand dynamics. Understanding the nuanced interplay between cost-push factors, where production costs drive prices upward, and demand-pull dynamics, where increased consumer demand outpaces supply, is crucial. These dynamics shape the overall trajectory of inflation and guide policy responses.

Individuals and the Erosion of Purchasing Power

One of the most direct consequences of inflation is the erosion of individuals’ purchasing power. As prices rise, the same amount of money buys fewer goods and services. This puts a strain on households as they grapple with increased costs for necessities, impacting their ability to maintain a desired standard of living.

Implications for Businesses and Pricing Strategies

Businesses operate within an environment shaped by inflationary pressures. Fluctuating production costs and consumer behavior necessitate adaptive pricing strategies. Balancing the need to maintain profit margins with the reality of consumer affordability becomes a delicate act for businesses navigating an inflationary landscape.

Central Bank Response and Interest Rate Policies

Central banks play a pivotal role in responding to inflationary pressures. Adjusting interest rates is a common tool used to influence economic activity. Raising interest rates can cool inflation by making borrowing more expensive, while lowering rates aims to stimulate economic growth. These policy decisions have cascading effects on borrowing costs, investment, and overall economic health.

Investment Challenges and Opportunities

Inflation introduces challenges and opportunities for investors. Fixed-income investments may see diminished real returns as the purchasing power of returns erodes. Conversely, certain assets like real estate and commodities may act as hedges against inflation. Crafting an investment strategy that considers the impact of inflation is essential for preserving and growing wealth.

Labor Market Dynamics and Wage-Price Spirals

Inflation can trigger a wage-price spiral, where rising prices lead workers to demand higher wages, contributing to a cycle of increased costs. Navigating this dynamic requires a delicate balance between ensuring fair compensation for workers and avoiding a spiraling effect that can exacerbate inflationary pressures.

Global Trade and Currency Dynamics

Inflation has implications for international trade and currency values. A country experiencing higher inflation than its trading partners may witness a depreciation of its currency. This, in turn, affects trade balances, import costs, and the competitiveness of goods and services on the global market.

Social and Political Ramifications of Inflation

Beyond economic realms, inflation carries social and political ramifications. Uneven distribution of the impact can exacerbate income inequality, potentially leading to social unrest. Governments must navigate these challenges, implementing policies that address both economic stability and social cohesion.

Long-Term Structural Adjustments in the Economy

Inflation often prompts long-term structural adjustments in economies. Governments and businesses may reassess fiscal policies, investment strategies, and regulatory frameworks to adapt to changing economic conditions. Flexibility and resilience become critical for entities navigating the evolving landscape shaped by inflation.

Conclusion: Strategies for Navigating Inflation’s Complexities

In conclusion, navigating the impact of economic inflation requires a comprehensive understanding of its dynamics and a strategic approach to both individual and macroeconomic decision-making. Explore more insights on Economic Inflation Impact to stay informed about strategies for mitigating the effects of inflation and fostering economic resilience.