Navigating Economic Trends: Bank of England Inflation Insights

Understanding inflation is a critical aspect of navigating economic trends, and the Bank of England plays a pivotal role in shaping the inflation landscape. In this article, we delve into the factors influencing inflation, the role of the Bank of England, and the insights it provides to businesses, investors, and the general public.

Inflation Dynamics: Grasping the Basics

Inflation refers to the general increase in prices of goods and services over time. It has far-reaching implications for the economy, impacting purchasing power, interest rates, and overall economic stability. Understanding the basics of inflation dynamics is essential for interpreting the insights provided by the Bank of England.

Bank of England’s Mandate: Maintaining Price Stability

The Bank of England, as the central bank of the United Kingdom, has a clear mandate to maintain price stability. This involves keeping inflation at a target rate, typically set by the government. The Bank utilizes various monetary policy tools to achieve this goal, such as interest rate adjustments and asset purchases.

Inflation Targeting: A Guiding Principle

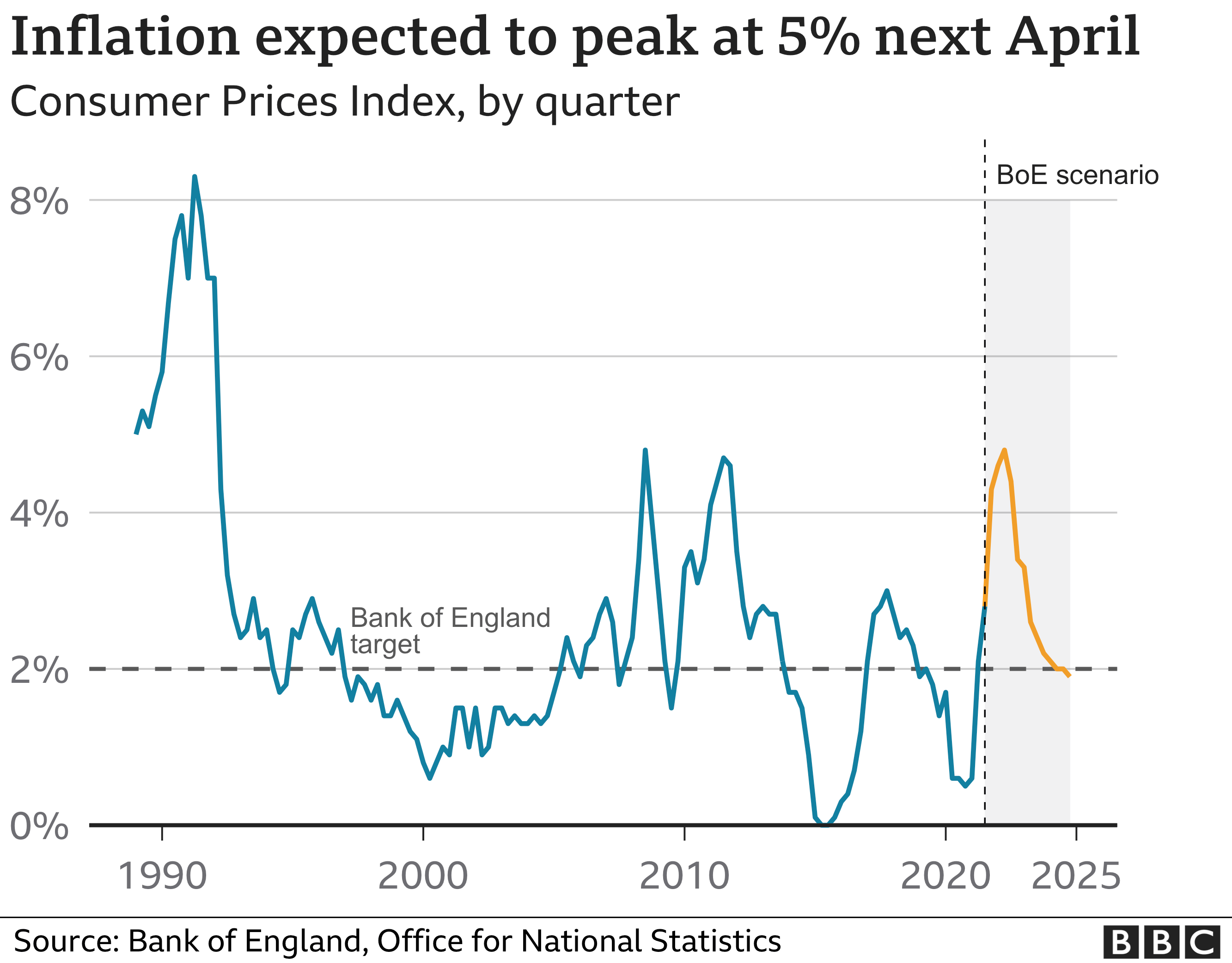

Inflation targeting is a key strategy employed by the Bank of England. The central bank sets a specific inflation target, commonly around 2%, and adjusts its policies to keep inflation close to this target. This approach provides a clear framework for businesses and investors, offering insights into the likely direction of interest rates and overall economic conditions.

Economic Indicators: Signals for Inflation Trends

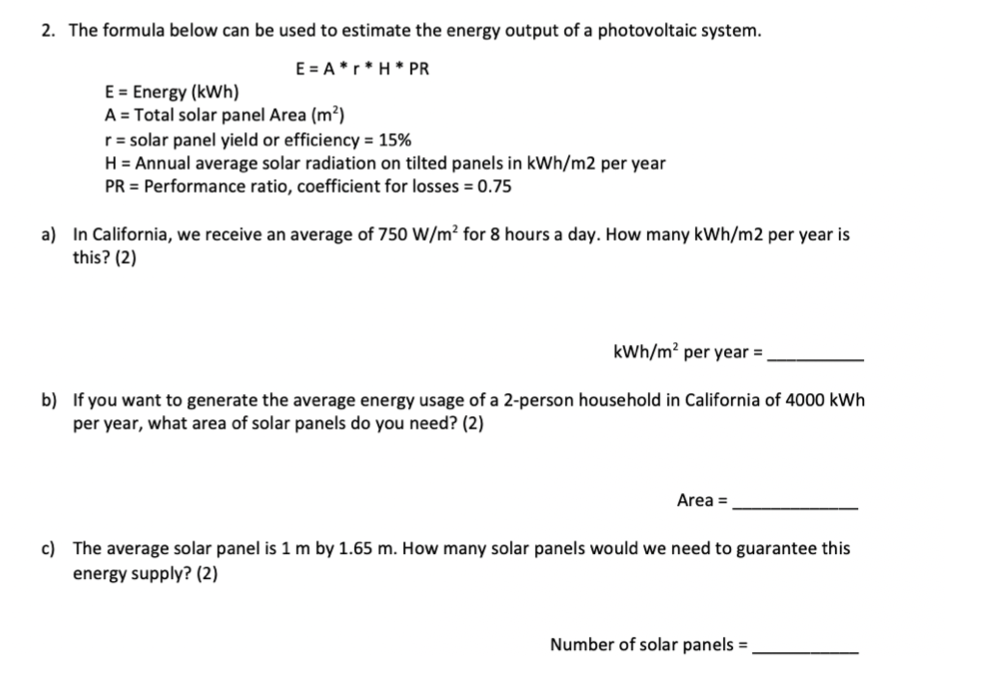

To provide accurate insights into inflation, the Bank of England closely monitors a range of economic indicators. These may include consumer price indices, wage growth, and overall economic output. By analyzing these indicators, the Bank gains a comprehensive understanding of the current inflationary pressures and adjusts its policies accordingly.

For the latest insights into Bank of England inflation and its impact on economic trends, explore detailed analyses at Bank of England Inflation. This resource offers valuable information for businesses and investors seeking a deeper understanding of inflation dynamics.

Global Perspectives: Considering External Factors

In today’s interconnected world, the Bank of England also considers global factors when assessing inflation trends. External events, such as international trade dynamics, geopolitical tensions, and economic developments in other major economies, can influence inflation in the UK. Understanding these global perspectives enhances the Bank’s ability to formulate effective monetary policies.

Forward Guidance: Communicating Policy Intentions

The Bank of England employs forward guidance as a means of communicating its policy intentions to the public. By providing clear and transparent information about its inflation targets and the factors influencing monetary policy decisions, the Bank aims to guide expectations and promote economic stability.

Inflation Reports: Insights into Policy Thinking

Regularly, the Bank of England releases Inflation Reports, which provide detailed analyses of economic conditions and inflation forecasts. These reports offer valuable insights into the Bank’s thinking, helping businesses and investors anticipate future policy moves. Accessing and understanding these reports is crucial for making informed financial decisions.

Market Impact: Responding to Bank of England Insights

The insights provided by the Bank of England have a direct impact on financial markets. Changes in interest rates or shifts in policy outlook can lead to fluctuations in currency values, bond yields, and stock prices. Businesses and investors closely monitor the Bank’s communications for cues on market conditions and adjust their strategies accordingly.

Adapting Strategies: Navigating Economic Uncertainties

In conclusion, staying informed about Bank of England inflation insights is integral for businesses and investors navigating economic uncertainties. By understanding the central bank’s policies, economic indicators, and global perspectives, stakeholders can adapt their strategies to align with the ever-changing economic landscape.