Empowering Futures: Teaching Kids Financial Literacy

Financial literacy is a crucial skill that empowers individuals from a young age. Teaching kids about money not only sets the foundation for responsible financial behavior but also equips them with essential life skills. Here’s a comprehensive guide on how to instill financial literacy in children.

1. Start Early with Basic Concepts

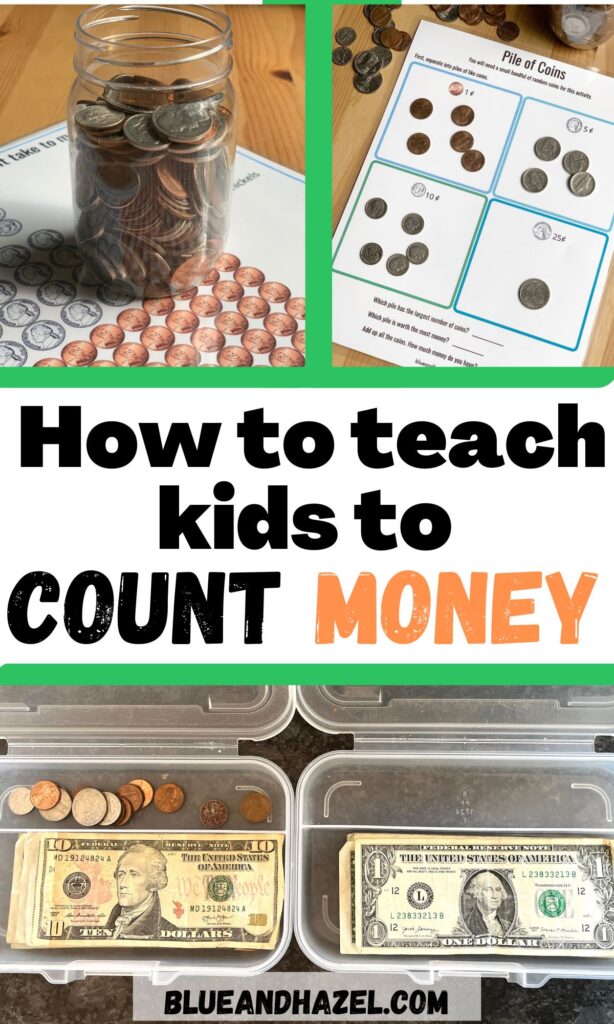

The journey of teaching kids about money begins early. Introduce basic financial concepts in an age-appropriate manner. Use tangible examples like play money to teach them about different denominations, the concept of earning, saving, and spending.

2. Make Learning Fun and Interactive

Engage kids in interactive and enjoyable activities to make learning about money fun. Board games, online simulations, and role-playing scenarios can help them understand financial concepts in a playful and interactive way. This approach fosters a positive attitude towards money management.

3. Set a Good Financial Example

Children often learn by observing their parents and caregivers. Set a good financial example by demonstrating responsible money habits. Discuss financial decisions openly, explain budgeting, and emphasize the importance of saving. Children are more likely to adopt positive financial behaviors when they see them modeled at home.

4. Introduce the Concept of Earning

Teach kids that money is earned through work and effort. This can be through simple tasks at home, like chores, or more complex activities as they grow older. Connecting the idea of effort to financial reward instills a strong work ethic and helps children understand the value of money.

5. Create a Savings Culture

Encourage kids to develop a savings habit from an early age. Provide them with a piggy bank or a savings account, and teach them the concept of setting aside money for future goals. This instills the idea of delayed gratification and the importance of saving for larger purchases.

6. Teach Responsible Spending

As kids mature, guide them in making responsible spending decisions. Discuss needs versus wants and help them prioritize their spending. Introduce the concept of budgeting by allocating money for different purposes, such as toys, treats, and savings.

7. Introduce Banking Concepts

Teaching kids about banking concepts is an integral part of financial literacy. Take them to the bank to open a savings account, and explain how interest works. Use online banking platforms to show them how to check balances and track transactions, introducing them to modern financial tools.

8. Discuss Giving and Philanthropy

Incorporate the value of giving back into financial education. Discuss charitable giving and involve kids in age-appropriate philanthropic activities. This fosters empathy, a sense of social responsibility, and an understanding of the positive impact money can have on others.

9. Address the Influence of Advertising

In a world surrounded by advertisements, help kids develop a critical perspective on consumerism. Discuss how advertisements can influence spending choices and teach them to make informed decisions rather than succumbing to impulsive purchases.

10. Gradually Introduce Investing Concepts

As kids approach their teenage years, gradually introduce them to the concept of investing. Explain the basics of stocks, bonds, and long-term investment strategies. While this may be more complex, providing a foundation in investing sets the stage for future financial success.

Teaching kids about money is an ongoing process that evolves as they grow. By instilling financial literacy from a young age, we empower them to make informed and responsible decisions, setting the stage for a financially secure future.

To explore more about teaching kids money and promoting financial literacy, visit Teaching Kids Money for comprehensive insights and resources.