Financial Literacy for Kids: Building Money Management Skills

Financial Literacy for Kids: Building Money Management Skills

Financial literacy is a crucial life skill, and instilling it in children from a young age lays the foundation for a responsible and informed approach to money. This article explores the importance of teaching kids finances and offers practical strategies for building money management skills.

The Significance of Early Financial Education

Introducing financial concepts to children at an early age sets the stage for a lifetime of responsible financial behavior. Understanding the value of money, budgeting, and saving are essential aspects of financial literacy that can positively impact a child’s future financial

Smart Strategies for Household Budgeting

Smart Strategies for Household Budgeting

Understanding the Importance of Budgeting

Effective household budgeting is the cornerstone of financial stability and responsible money management. It involves strategically allocating income to cover expenses, save for the future, and potentially invest. This article explores smart strategies for household budgeting, providing insights into achieving financial well-being.

Creating a Realistic Budget

The first step in effective household budgeting is to create a realistic budget that reflects your income, expenses, and financial goals. Take a comprehensive look at your monthly income, including all sources of earnings. Subsequently, list and categorize your regular expenses such as rent

Parental Budget Mastery: Smart Financial Tips for Families

Parental Budget Mastery: Smart Financial Tips for Families

Managing a family budget can be a challenging task, but with the right strategies, parents can navigate the financial landscape successfully. In this article, we’ll explore some smart financial tips that can help families achieve budget mastery.

Understanding Your Income and Expenses

The first step in achieving parental budget mastery is gaining a clear understanding of your family’s income and expenses. Create a detailed list of all sources of income, including salaries, bonuses, and any other additional income. Similarly, document all monthly expenses, such as bills, groceries, and miscellaneous costs. This comprehensive

Empowering Finances: Personal Finance Education

Empowering Finances: Personal Finance Education

Financial literacy is a cornerstone of individual empowerment and well-being. In this article, we delve into the significance of personal finance education, exploring its impact on financial decision-making, long-term planning, and overall financial health.

Understanding the Basics of Personal Finance

Personal finance education starts with understanding the basics. It encompasses budgeting, saving, investing, and debt management. Individuals gain insights into creating a balanced financial plan that aligns with their goals and lifestyle. This foundational knowledge forms the bedrock for informed financial decisions.

Navigating the Complexities of Budgeting

Budgeting is a fundamental aspect of personal finance

Guiding Your Family’s Finances: Practical Tips for Success

Guiding Your Family’s Finances: Practical Tips for Success

Managing your family’s finances is a significant responsibility that requires careful planning and strategic decision-making. In this article, we’ll explore practical tips for providing effective family financial guidance to ensure long-term financial success.

Assessing Your Financial Situation

Before offering financial guidance to your family, it’s crucial to assess your current financial situation. Review your income, expenses, debts, and savings. Understanding where you stand financially sets the foundation for creating a realistic and effective financial plan.

Setting Clear Financial Goals

Establishing clear financial goals is a key step in guiding your family’s finances.

Empowering Generations: Family Wealth Education

Empowering Generations: Nurturing Wealth Education within Families

Introduction: The Significance of Family Wealth Education

In the journey of wealth management, family wealth education plays a pivotal role in ensuring a legacy of financial understanding and responsible stewardship. This article explores the importance of family wealth education, its impact on generational wealth, and strategies to empower family members with financial knowledge.

Foundations of Financial Literacy: Starting Early

The roots of financial literacy are often embedded in childhood. Family wealth education begins by instilling basic financial concepts at an early age. Teaching children about budgeting, saving, and the value of money lays

Making Wise Money Choices for a Responsible Future

Making Wise Money Choices for a Responsible Future

Money choices are not just about personal finance; they have broader implications for the well-being of individuals, communities, and the planet. In this article, we explore the concept of responsible money choices and how they contribute to a sustainable and ethical financial landscape.

Understanding Responsible Money Choices

Responsible money choices go beyond simply managing one’s finances. It involves considering the social and environmental impact of financial decisions. This includes mindful spending, ethical investments, and supporting businesses with sustainable practices. Understanding the impact of our financial choices is the first step towards responsible

Building Family Wealth: Strategies for Financial Success

Building Family Wealth: Strategies for Financial Success

Financial success is a common aspiration for families, and achieving it requires thoughtful planning and strategic decision-making. In this article, we explore key strategies that families can adopt to build and sustain financial success, fostering long-term stability and prosperity.

Setting Financial Goals: The Foundation of Success

The journey towards family financial success begins with setting clear and achievable financial goals. These goals act as a roadmap, providing direction and purpose for financial decisions. Whether it’s saving for education, homeownership, or retirement, having well-defined goals helps guide family financial planning.

Budgeting Basics: Managing Income

Empowering Futures: Teaching Kids Financial Literacy

Empowering Futures: Teaching Kids Financial Literacy

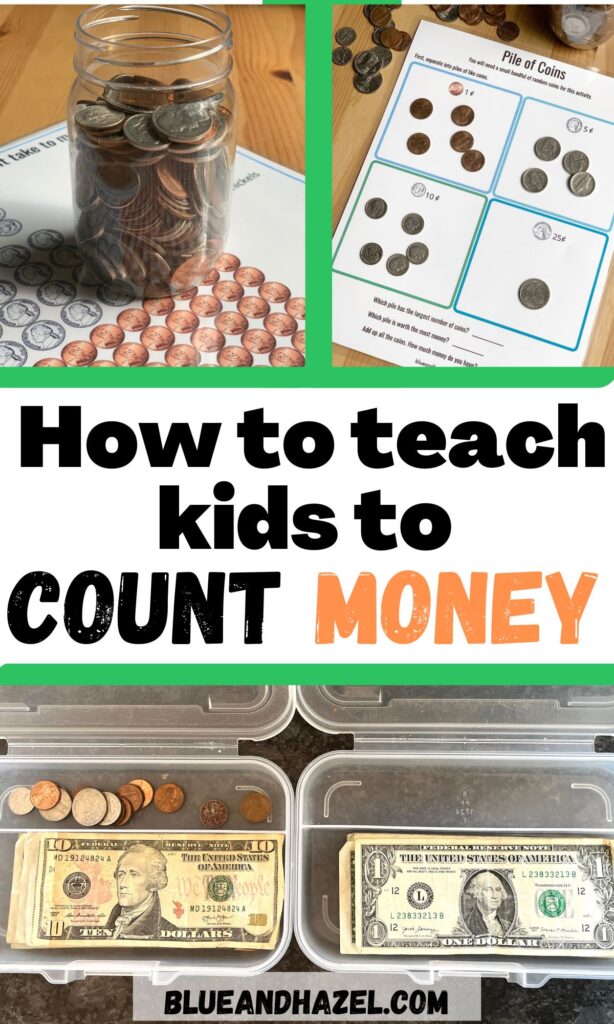

Financial literacy is a crucial skill that empowers individuals from a young age. Teaching kids about money not only sets the foundation for responsible financial behavior but also equips them with essential life skills. Here’s a comprehensive guide on how to instill financial literacy in children.

1. Start Early with Basic Concepts

The journey of teaching kids about money begins early. Introduce basic financial concepts in an age-appropriate manner. Use tangible examples like play money to teach them about different denominations, the concept of earning, saving, and spending.

2. Make Learning Fun and Interactive