Understanding the Complexities of Inflationary Forces Analysis

Introduction: The Significance of Analysis

In the intricate tapestry of the economy, the analysis of inflationary forces holds a pivotal role. It is a multidimensional examination that requires a comprehensive understanding of various factors influencing economic trends. This article delves into the complexities of inflationary forces analysis, shedding light on its significance and impact.

Contributors to Inflation: A Multifaceted Approach

To comprehend inflationary forces, one must dissect the numerous contributors to this economic phenomenon. From demand-pull dynamics driven by consumer behavior to cost-push pressures arising from increased production costs, the landscape is intricate. Analyzing these multifaceted aspects provides a nuanced view of the forces at play.

Central Bank Policies: Orchestrating Stability

Central banks play a crucial role in managing inflation through monetary policies. Adjusting interest rates and influencing the money supply are instruments they employ to strike a delicate balance. The effectiveness of these policies requires meticulous scrutiny, as they shape the economic environment and directly impact inflationary trends.

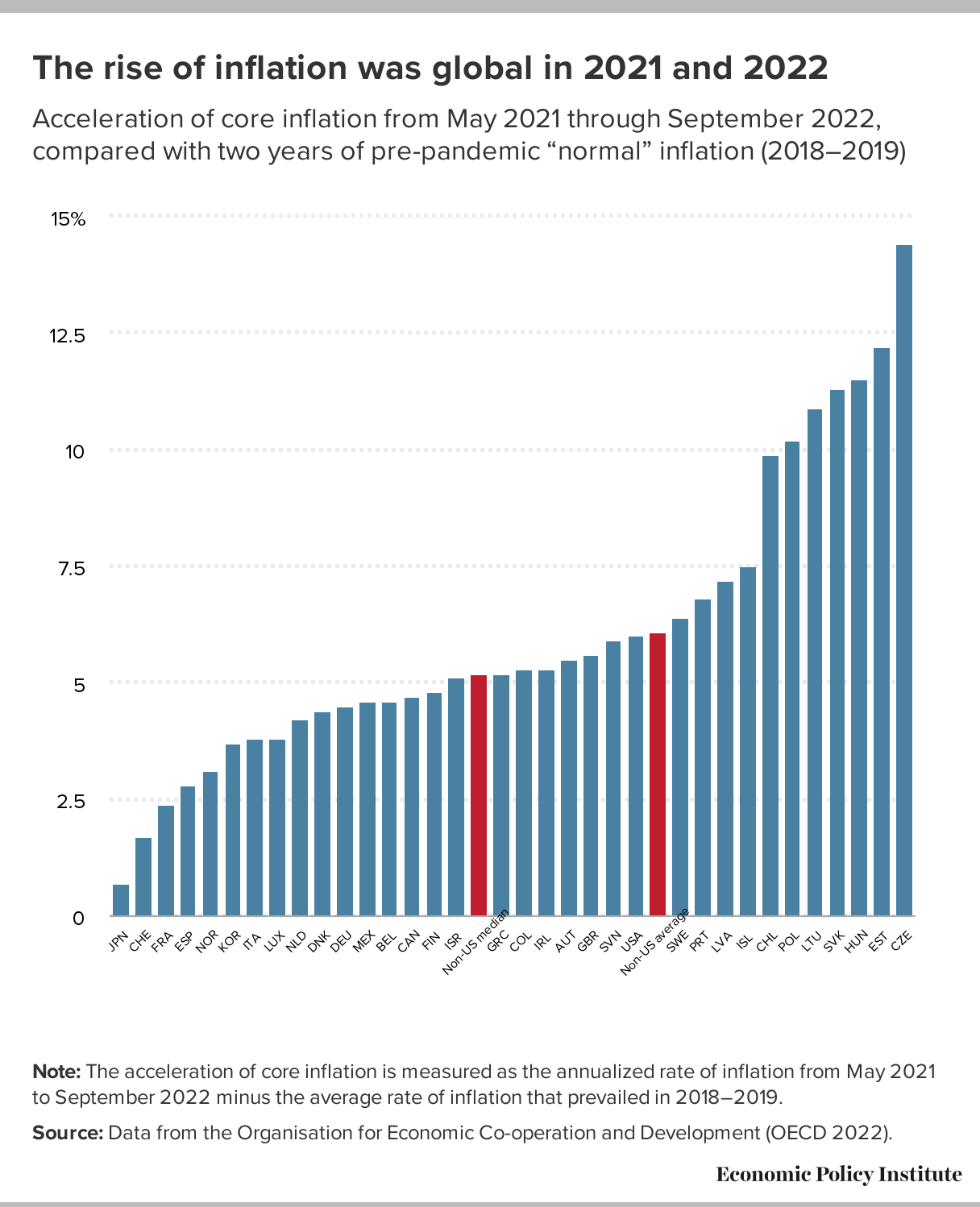

Global Dynamics: The Ripple Effect

In an interconnected world, global events and geopolitical dynamics have a profound impact on inflation. Trade tensions, conflicts, or natural disasters can disrupt supply chains and create inflationary pressures. Understanding these global influences is imperative for a comprehensive analysis of inflationary forces and their potential ramifications.

Consumer Behavior: A Psychological Dimension

Consumer behavior introduces a psychological dimension to inflationary forces. Expectations and sentiments of consumers can influence their spending patterns, contributing to demand-pull inflation. Analyzing consumer behavior provides insights into potential inflationary trends and the overall economic sentiment.

Asset Price Inflation: Beyond Consumer Goods

Inflationary forces extend beyond consumer goods to impact asset prices, including real estate and financial markets. The implications of asset price inflation necessitate specialized analysis. Factors such as low-interest rates and speculative behavior contribute to this phenomenon, influencing investment strategies and economic stability.

Inflationary Forces Analysis: Navigating Economic Trends

Amidst the intricacies of inflationary forces, seeking insights from experts becomes crucial. Clicking on the provided link to Inflationary Forces Analysis opens a gateway to a deeper understanding of economic trends. Their expertise guides financial planning in dynamic environments, aiding individuals and businesses in navigating the challenges posed by inflation.

Risk Mitigation Strategies: A Proactive Approach

Mitigating risks associated with inflation requires a proactive stance. Businesses can implement strategic pricing, negotiate contracts, and diversify supply chains to manage cost-push inflation. Individuals can focus on diversified investments, including assets historically resilient to inflation, such as real estate and commodities.

Adapting to Economic Uncertainties

In conclusion, a comprehensive analysis of inflationary forces is instrumental for adapting strategies that promote economic resilience. Whether scrutinizing demand-pull dynamics, evaluating central bank policies, or considering global events, a multifaceted understanding is key. Engaging with experts in inflationary forces analysis facilitates informed decisions, helping individuals and businesses navigate economic uncertainties successfully.