Upgrade Your Home with Professional Remodeling Services

Subheading: Enhancing Your Living Environment

Transforming your home into the ideal living space often requires more than just a fresh coat of paint or new furniture. It’s about creating a space that reflects your style, meets your needs, and enhances your daily life. Professional remodeling services are the key to achieving this transformation, offering expertise, creativity, and craftsmanship to turn your vision into reality.

Subheading: The Role of Professional Remodeling Services

Professional remodeling services play a pivotal role in upgrading and revitalizing your home. They bring years of experience and knowledge to the table, guiding you through every step of

Reliable Bathroom Repair Contractors at Your Service

Reliable Bathroom Repair Contractors at Your Service

Transforming Your Bathroom with Expertise

In the realm of home improvement, few projects offer as much potential to enhance both aesthetics and functionality as bathroom repairs. Whether you’re dealing with a leaky faucet, outdated fixtures, or a complete overhaul, finding reliable contractors is paramount to the success of your project.

Why Choose Reliable Contractors?

When it comes to something as vital as your bathroom, you don’t want to leave anything to chance. Reliable contractors bring a wealth of experience, expertise, and professionalism to the table. From the initial consultation to the final touches,

Economic Recession Concerns: Navigating Uncertain Financial Terrain

Navigating Economic Recession Concerns: Strategies for Uncertain Financial Terrain

Understanding Economic Recession: A Prelude to Uncertainty

Economic recession concerns can send shockwaves through financial landscapes, impacting businesses and individuals alike. Understanding the factors leading to a recession is essential for devising strategies to navigate the uncertain terrain that follows. As economic indicators fluctuate, adapting to the evolving financial climate becomes a crucial aspect of resilience.

Impact on Businesses: Challenges and Opportunities

In times of economic recession, businesses face both challenges and opportunities. Cost-cutting measures may be necessary to weather the storm, but innovative strategies can also emerge. Adapting business models,

Local Bathroom Remodel Pros Transform Your Space Today!

Unlock the Potential of Your Bathroom with Expert Remodeling

Are you tired of your outdated bathroom? Do you dream of a space that is both functional and beautiful? Look no further! Local bathroom remodel pros are here to transform your space and turn your vision into reality.

Expertise That Makes a Difference

When it comes to remodeling your bathroom, you want to work with professionals who understand your needs and can deliver exceptional results. Local remodel pros have the expertise and experience to handle every aspect of your project, from design to installation.

Tailored Solutions for Your Space

Every bathroom

Revitalize Your Home Home Depot Renovation Services

Transform Your Living Space with Home Depot Renovation Services

Unleashing the Potential of Your Home

In the world of home renovation, few names stand out like Home Depot. With their comprehensive range of renovation services, they’ve become synonymous with quality craftsmanship and unparalleled expertise. Whether you’re looking to update your kitchen, remodel your bathroom, or transform your entire home, Home Depot has the solutions you need to revitalize your living space and bring your vision to life.

Comprehensive Renovation Solutions

One of the key advantages of choosing Home Depot for your renovation needs is their comprehensive range of services. From

Wind Power Unleashed: Advancements in Turbine Technology

Wind Power Unleashed: Advancements in Turbine Technology

Harnessing the power of the wind has long been a cornerstone of sustainable energy efforts. In this article, we explore the cutting-edge developments in wind turbine technology, delving into innovations that are reshaping the landscape of renewable energy.

The Evolution of Wind Turbine Design

Wind turbine technology has undergone a remarkable evolution in design. From traditional horizontal-axis turbines to modern vertical-axis designs, engineers continually seek ways to maximize energy capture and efficiency. Innovations in aerodynamics and materials have contributed to more streamlined and effective turbine structures.

Increasing Turbine Size for Enhanced Efficiency

One

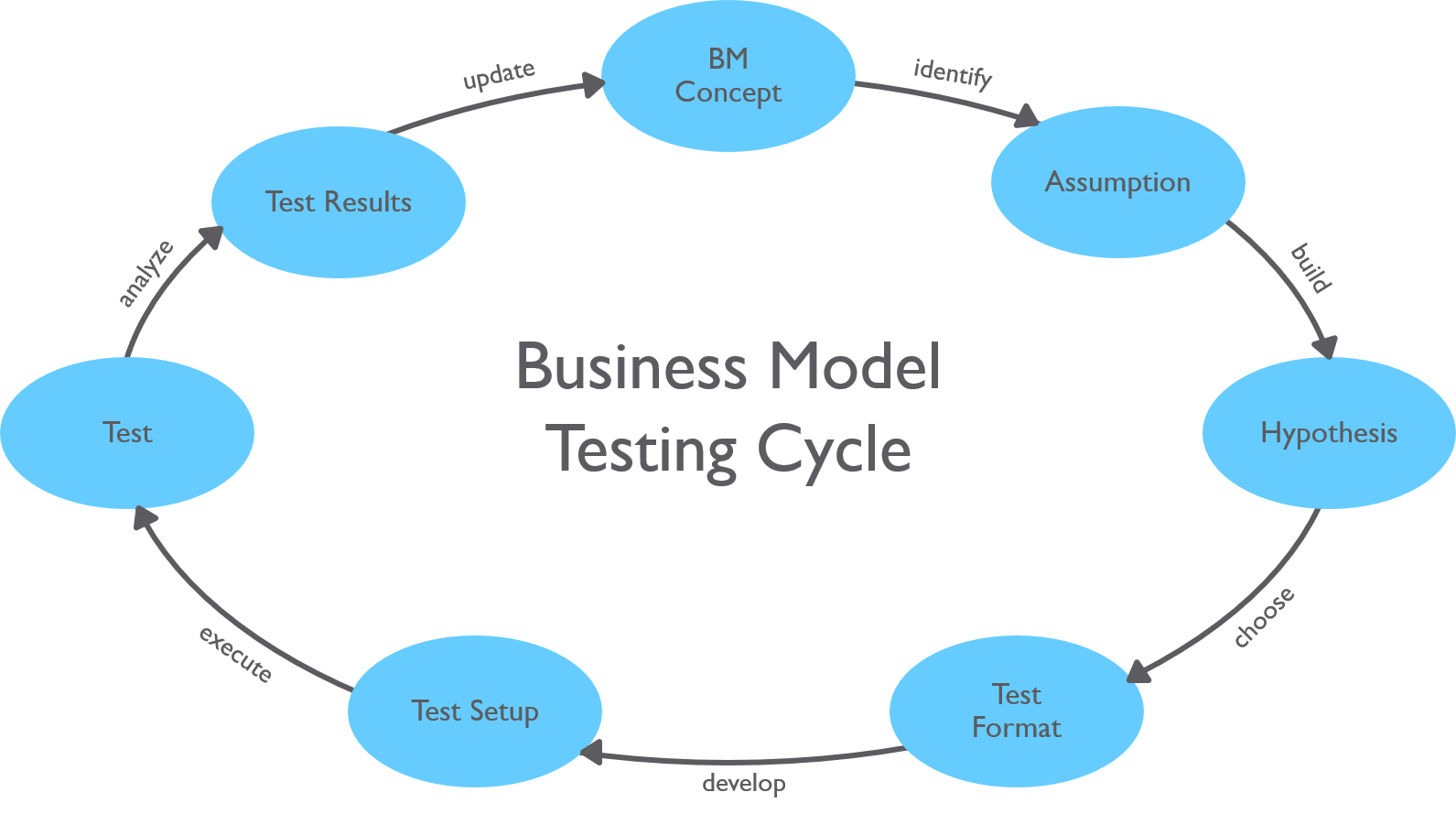

The Key Elements of a Successful Business Model

[ad_1]

In order for a business to be successful, it needs to have a solid business model. A business model is essentially the plan or blueprint for how a company will generate revenue and make a profit. There are a number of key elements that must be present in a successful business model, and understanding these elements is essential for any entrepreneur or business owner.

1. Value Proposition:

One of the most important elements of a successful business model is the value proposition. This is essentially the promise that your business makes to customers about the value it will provide …

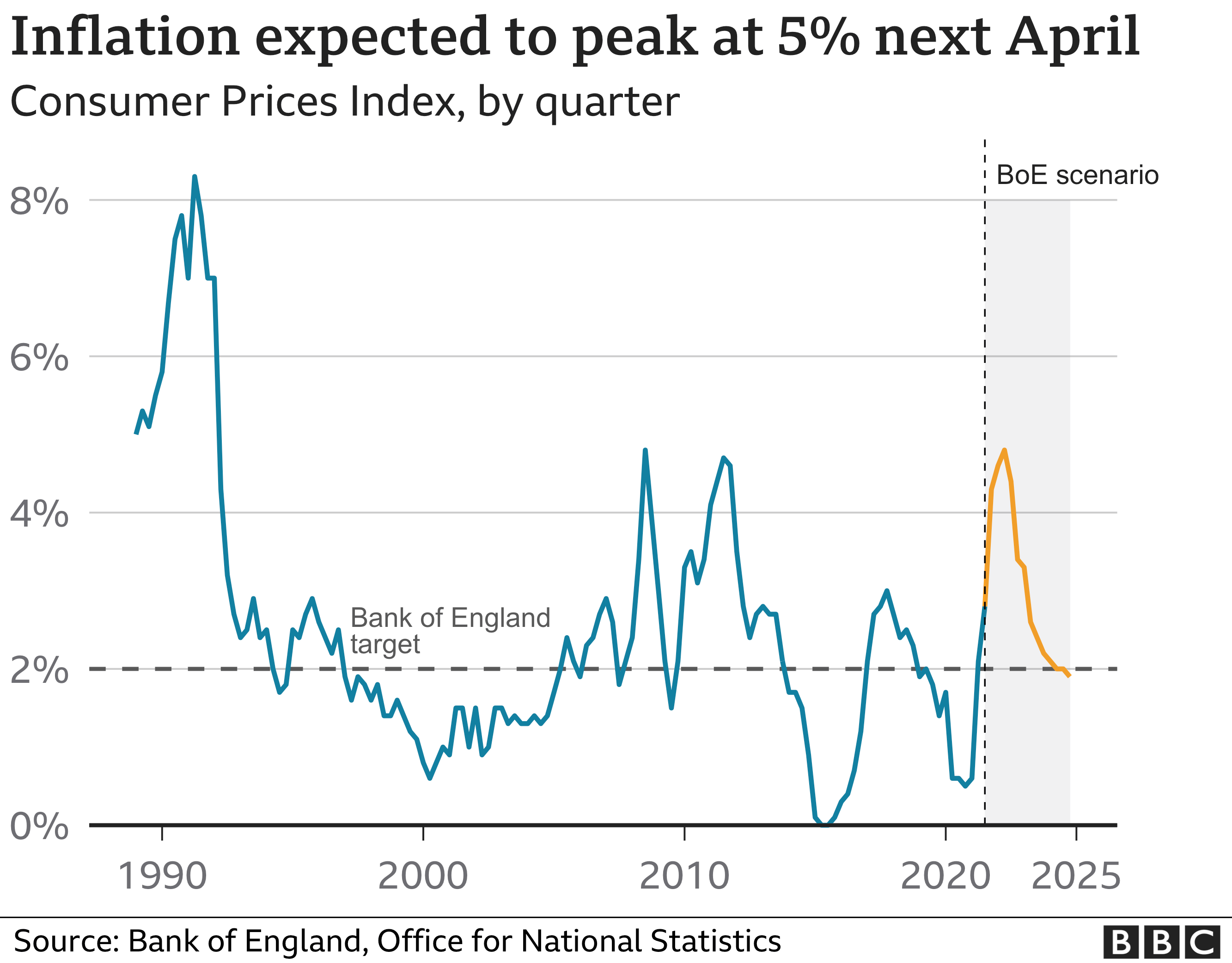

Navigating Economic Trends: Bank of England Inflation Insights

Navigating Economic Trends: Bank of England Inflation Insights

Understanding inflation is a critical aspect of navigating economic trends, and the Bank of England plays a pivotal role in shaping the inflation landscape. In this article, we delve into the factors influencing inflation, the role of the Bank of England, and the insights it provides to businesses, investors, and the general public.

Inflation Dynamics: Grasping the Basics

Inflation refers to the general increase in prices of goods and services over time. It has far-reaching implications for the economy, impacting purchasing power, interest rates, and overall economic stability. Understanding the basics of

Renewable Energy Optimization: Sustainable Management Strategies

Renewable Energy Optimization: Sustainable Management Strategies

As the world grapples with environmental concerns, the focus on renewable energy has intensified. Efficient management of renewable energy resources is crucial for a sustainable future. In this article, we delve into strategies for optimizing renewable energy.

Understanding the Importance of Renewable Energy

Renewable energy, derived from natural sources like sunlight, wind, and water, is a key player in the shift towards sustainable energy solutions. Recognizing the importance of renewable resources is the first step towards establishing effective management strategies.

Harnessing Solar Power: A Bright Approach

Solar energy, abundant and eco-friendly, holds immense potential.

Economic Pressure on Ukraine: Challenges and Resilience

Economic Pressure on Ukraine: Challenges and Resilience

The economic landscape of Ukraine has been marked by significant challenges, including geopolitical tensions and external pressures. This article explores the economic pressures facing Ukraine and the resilience demonstrated by the nation.

Geopolitical Tensions and Economic Impact

Ukraine has been at the center of geopolitical tensions, particularly in its relationship with Russia. The annexation of Crimea and the ongoing conflict in Eastern Ukraine have created a complex geopolitical environment, impacting the nation’s economic stability.

Sanctions and Trade Restrictions

International responses to geopolitical events have led to economic sanctions and trade restrictions imposed on